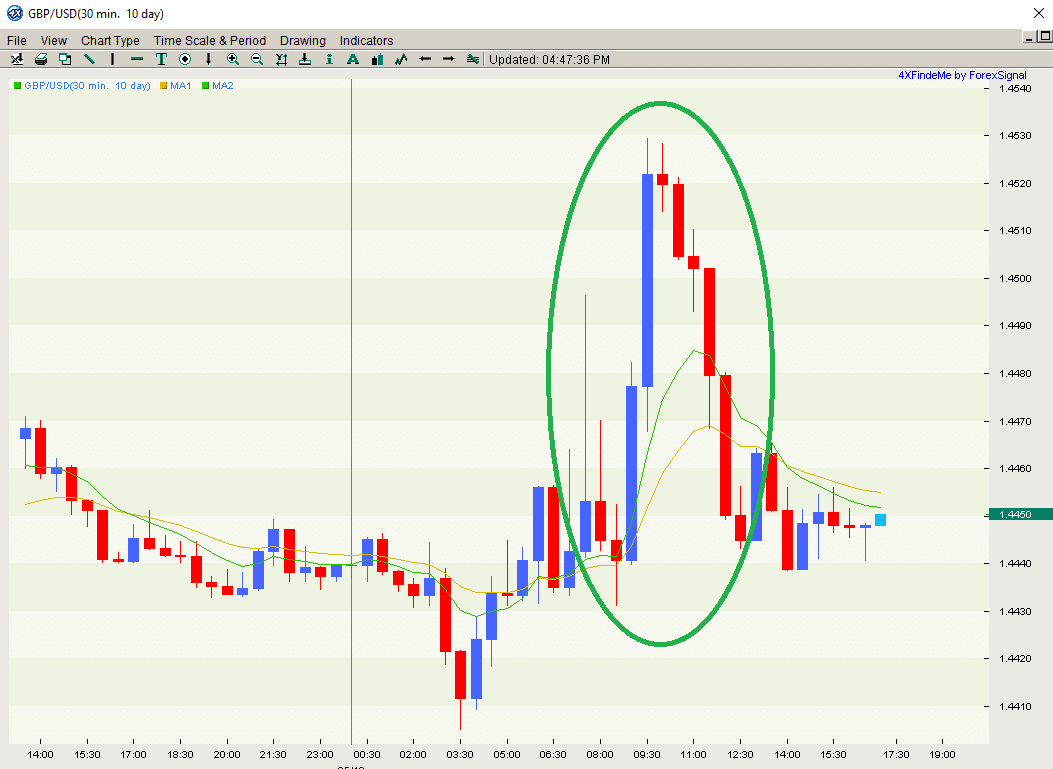

Today’s Bank of England events – when the BoE released its rate decision, meeting minutes, and Quarterly Inflation Report, earned today the title of a “Super Thursday”. In reality, it wasn’t such a “super” day after all with the GBPUSD spiking as high as 1.4529, only to return steadily to its starting point. We see support setting up at 1.4439 which is almost the same level the market started at prior to all the BoE releases.

BoE Delivers No Surprises

Just as most analysts expected, after today’s releases it has become almost certain that the BoE will continue to keep their policy unchanged as the bank’s officials voted across the board to leave the main interest rate at a low 0.5%. The hot topic, of course, was the Brexit referendum on June 23rd when Britain will vote on whether to leave the European Union.

Brexit Warnings

The Bank of England discouraged the vote to leave the EU with warnings of a standstill on economic growth in the U.K., a rise in unemployment and inflation, as well as the potential economic costs of leaving the EU.

Mr. Mark Carney, Governor of the Bank of England and Chairman of the G20’s Financial Stability Board, said that a vote may even push the U.K. economy into a “technical recession,” – that is with output declines for at least two straight quarters. The BOE’s Monetary Policy Committee warned that if the vote in favor of exiting the EU goes through, it can prompt events that would lead to a sharp fall in the value of the sterling currency.

What About The Mighty Greenback?

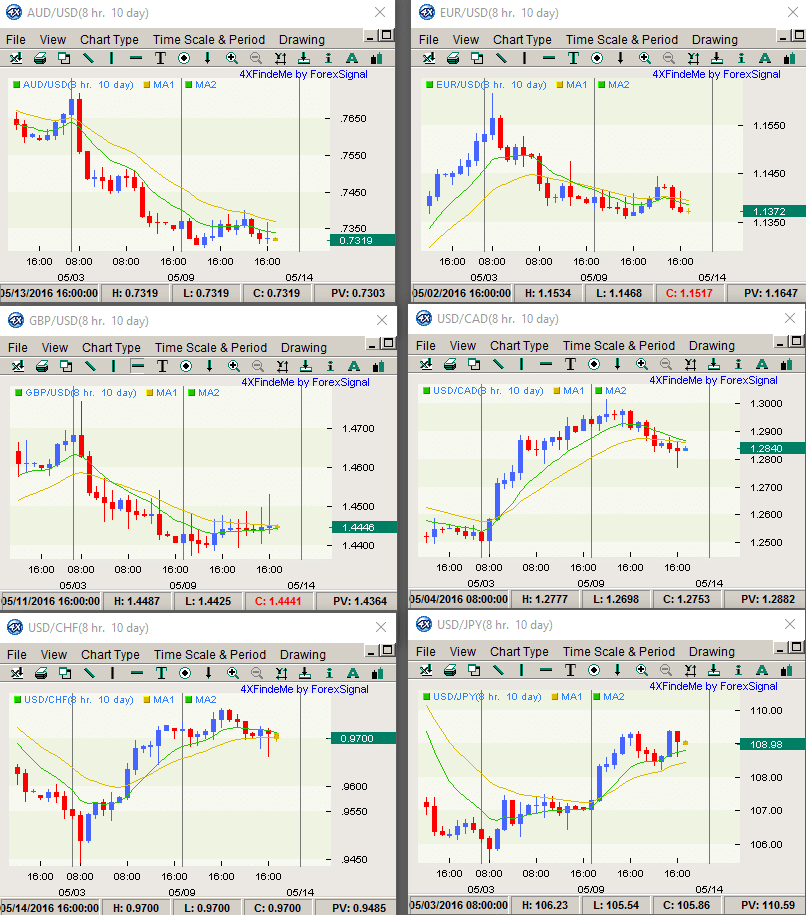

The Greenback has had an impressive May up until now and has gained against all of its major counterparts. So far the behavior for May is keeping with the seasonal bias of a strong US Dollar with strong sentiment favoring continued strength.

All eyes are on to

Can we expect the USD reign to continue? This must read article on dailyfx explores the fundamental and technical expectations.

In the meanwhile, at ForexSignal.com we are analyzing the situation and looking for short and long USD opportunities and we will send Forex signals to our clients all over the world as trades are confirmed.

Leave a Reply

You must be logged in to post a comment.