Jobs Report

Jobs Report

The U.S. added 52,000 jobs more than expected on this first Non-Farm Jobs report (NFP) release since the inauguration of President Trump. The jobless rate in the U.S. is down to a low 4.8% as employers added the most workers in four months. Not all the news was good though; wage growth slowed more than expected which suggests that some slack remains in the labor market.

The data represents the final figures under President Obama, and indicates that the job market is still sustaining stable growth, but isn’t quite strong enough yet for an increase in worker pay.

NFP’s Effect On USD

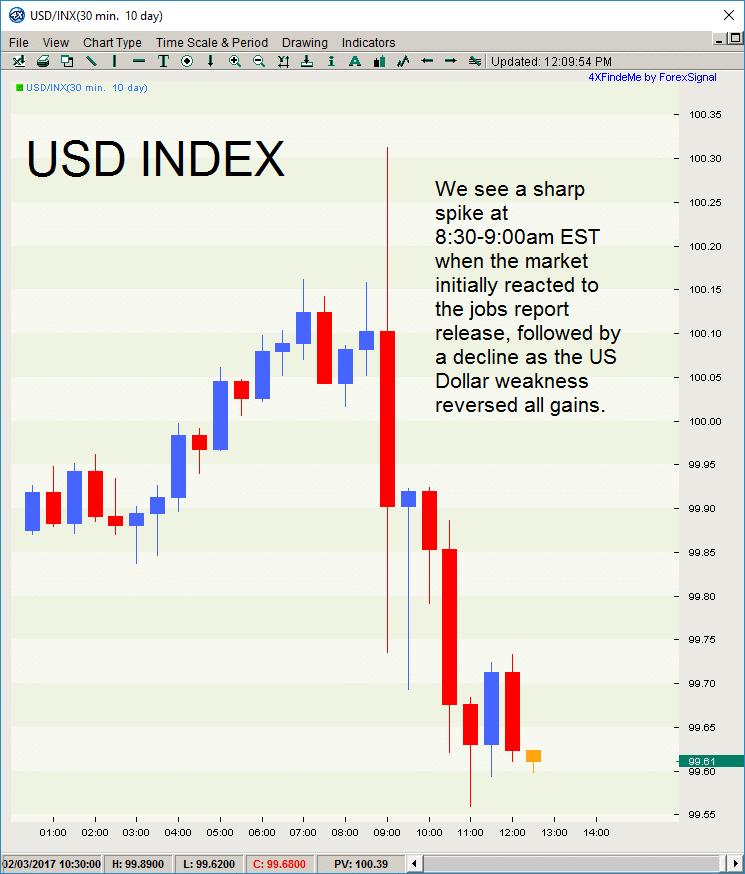

While the NFP report seemed initially strong for the Greenback, the market’s reaction to the slowed wage growth was a dovish signal to the USD. Once all this was digested, the Greenback reacted by reversing all the initial gains and then some. At market closing on Friday, we ended up with more U.S. dollar weakness as the Greenback slowed against all its major counterparts.

The USD Index shows this clearly as we see a sharp spike at 8:30-9:00am EST when the market initially reacted to the jobs report release, followed with dollar weakness as shown on the 30 minute USD/INX chart below.

Rate Hikes Ahead?

The Fed left interest rates unchanged on Wednesday February 1st and hinted that there is still space to see improvement in the job market.

Could this months mixed Jobs report be enough uncertainty for the Fed to leave rates unchanged at their next meeting? Time will tell.

The Federal Open Market Committee also takes into consideration fiscal policy; tax reform and infrastructure spending which are strong drivers of inflation expectations. So as the Trump Administration makes these policies clearer, the Fed will have much to chew on in making their decision on a Fed rate hike.

For now, the USD remains vulnerable and we aren’t going to make statements that the Greenback is sure to be headed one way or another.

February Trading

All this uncertainty on the US Dollar makes for an exciting month of trading Forex in February. We look forward to Forex trading in the days and weeks ahead and we will alert our Forex signal subscribers when it is time to trade.

Jobs Report

Jobs Report

Leave a Reply

You must be logged in to post a comment.