Dollar Bulls

The USD bulls came out to play today as the Greenback rallied against all major currencies for its biggest advance after 3 weeks of bearish trading.

Euro, Pound

The Euro weakened due to political risks, but the biggest loser of all was the British pound as it fell to a 2-week low against the USD. The sterling’s declined was based on underlying concerns about Britain’s exit from the EU, as well as a fall in retail sales data.

After several weeks of strong recovery on the GBP and a sell-off move on the U.S. Dollar, the markets were primed for a correction and today we saw that movement.

ForexSignal.com clients benefited from this move with the GBPUSD signal to sell at 1.2448, and after 17 hours of being active in this trade, we finally closed the trade at our Target 3 and banked 60 pips for our Trade Copier clients.

The GBP has gained back most of its losses against the USD overnight, but now it is still trading lower than its February high of 1.2706.

USD Index

The USD Index reflects the 2-day USD rally as it finally picked up steam in the upward direction and hit a high of 100.72 for the first time this February.

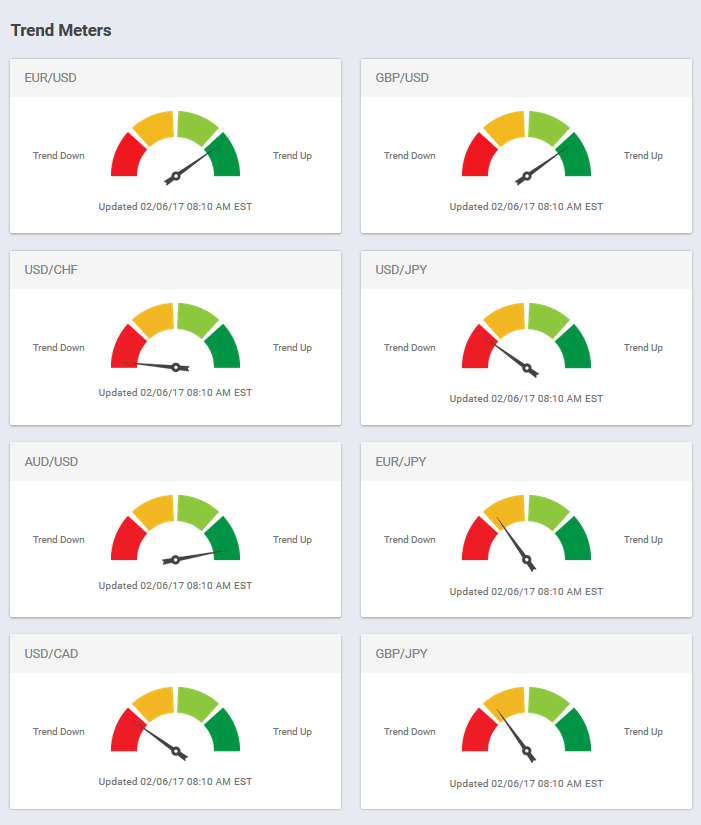

Trend Meters

The ForexSignal Trend Meters, updated daily and available to all ForexSignal.com clients, show that the trend is still against a strong U.S. Dollar for now, but as we well know, the trend can change at any time and a few more strong days for the Greenback bulls could shift the Trend Meters in the other direction.

Our Trading Team will keep a close eye on the market and be alert to any changes in the trend.

Leave a Reply

You must be logged in to post a comment.