FOMC Commentary

FOMC Commentary

The Federal Open Market Committee’s announcement shocked no one after it was announced that they would hold the main overnight benchmark rate into a range of 1.00-1.25%, as was priced into the market well in advance of today’s policy meeting. Prior to this decision, Feds funds features were expecting a 0% chance of a rate move today. Besides, it was an “unnecessary” meeting that transpired no new summary of economic projections (SEPs) were released nor was there a press conference by Fed Chair Janet Yellen.

The sad news though was for the greenback, the FOMC’s July policy statement wasn’t hawkish enough to stem the recent bleeding. The Fed did acknowledge that the risks to the economic outlook appear “roughly balanced,” they also noted that inflation is expected to stay “somewhat below” 2% in the near-term.

Immediately after the Fed’s policy decision, the market-affected glide path of interest rates remained little changed. Prior to the rate decision, markets were pricing in a 60% chance of a 25-bps in March 2018; after, markets were pricing in a 55% chance of a hike in March 2018.

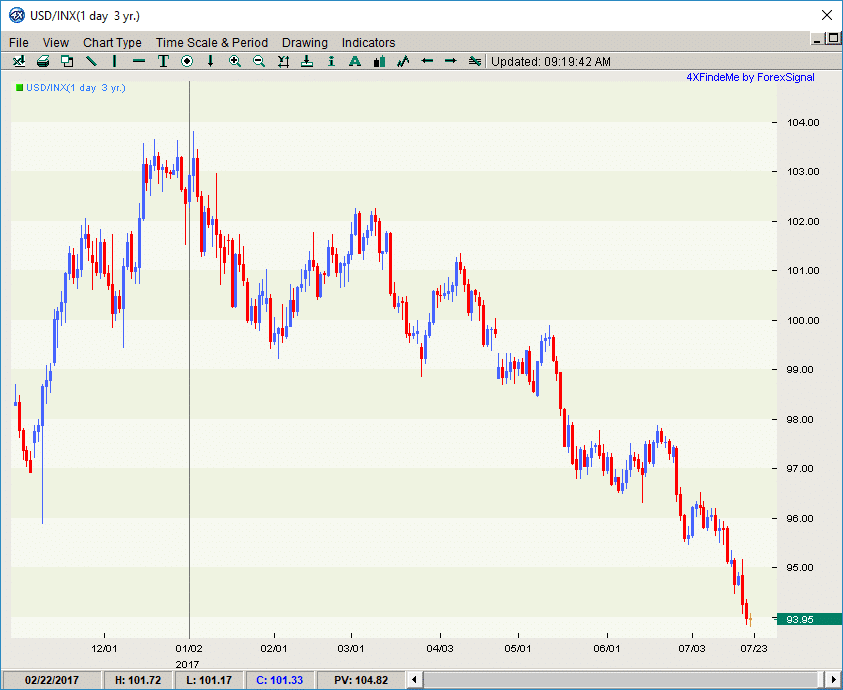

USD Index

Despite dovish outlook on the USD, today we saw major reversals as the USD gained against its major counterparts; USD Index trading higher at 94.10 earlier on Thursday.

Forex Signal: GBP/JPY

Prior to the Rate decision, our ForexSignal team sent a signal for a non-USD currency pair – the GBP/JPY. We bought at 145.95; and the trade went on to reach 45 pips (exactly our Target set for our Trade Copier) before it returned back to the entry point price.

FOMC Commentary

FOMC Commentary

Leave a Reply

You must be logged in to post a comment.