Political Tensions Trump Positive Economic Growth

Political Tensions Trump Positive Economic Growth

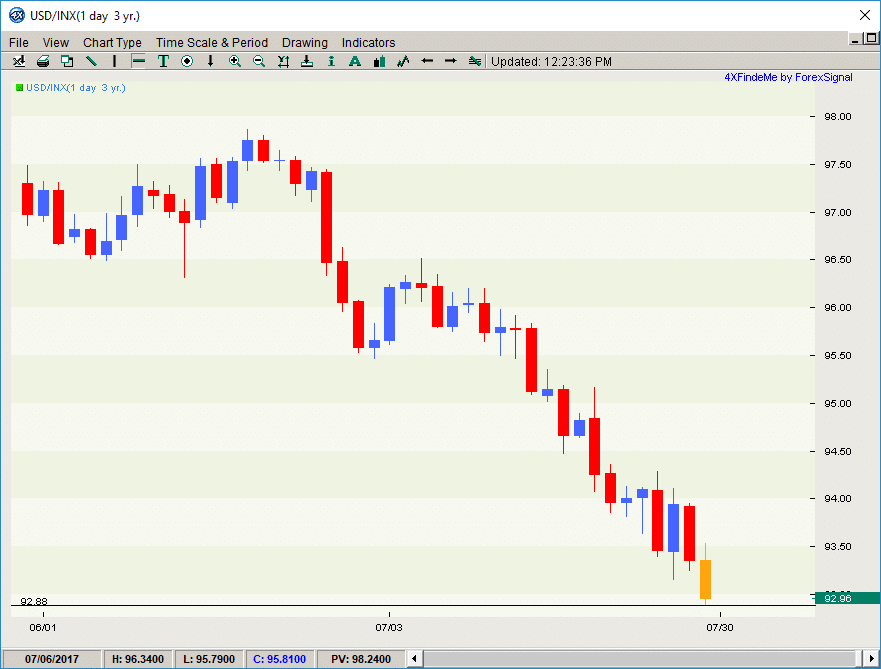

The US dollar received some much needed support at the latter end of last week from the better than expected pace of economic expansion. US GDP grew by 2.6% in the second quarter of 2017, which is 0.1% more than forecast. Positive statistics on the GDP growth in America leads to an increased probability of another rate hike by the Fed in 2017.

Political tensions in the US, however restrain the USD bulls. U.S. stocks dropped and fluctuated on Monday also leading to a drop in the Greenback, and the USD Index has touched a fresh new low for 2017, trading as low as 92.88.

Loonie

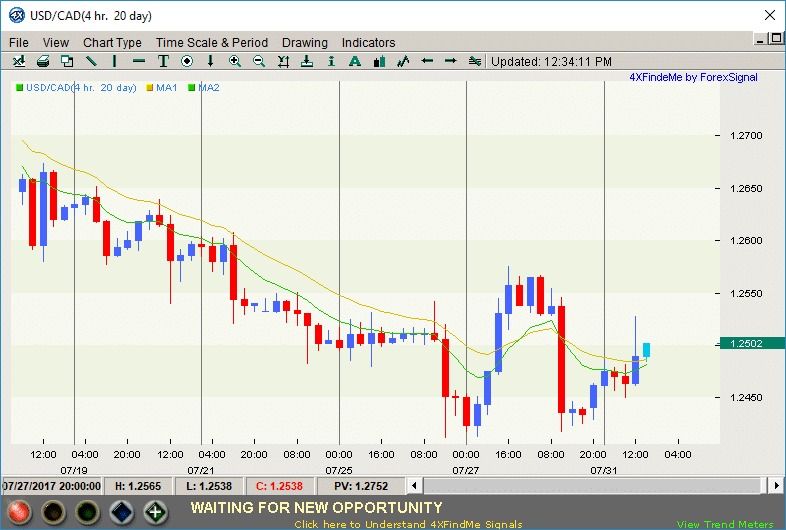

Last week the Canadian dollar resumed its positive dynamics after some consolidation. The trigger for the sharp rise of the Canadian currency was the unexpectedly strong GDP figures in May, according to which the indicator rose by 0.6% in May, against the expected 0.2%. The positive impulse was also due to rising prices for crude oil, a key export product for Canada. In today’s trading, the greenback is fighting its northern neighbor and at ForexSignal.com we are watching this pair closely to see if the current retracement on the USDCAD pair is simply a consolidation or perhaps a setup for a change in the trend.

Euro

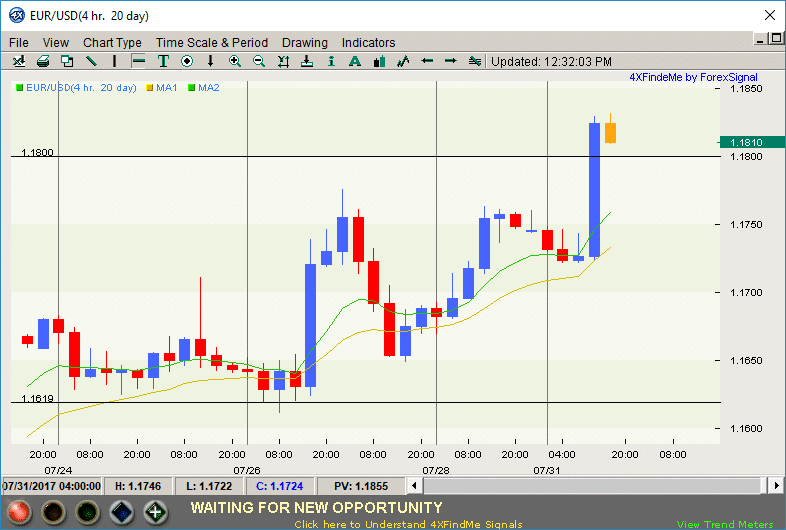

Euro quotes kept moving within the limits of the rising channel despite better than expected data on the GDP growth in the US. In today’s trading we hit the next big figure 1.1800, the overcoming of which may open the way to the psychologically important 1.2000 mark. On the other hand, in order to switch to negative dynamics, the price needs to break through the strong support at 1.1620.

Cable

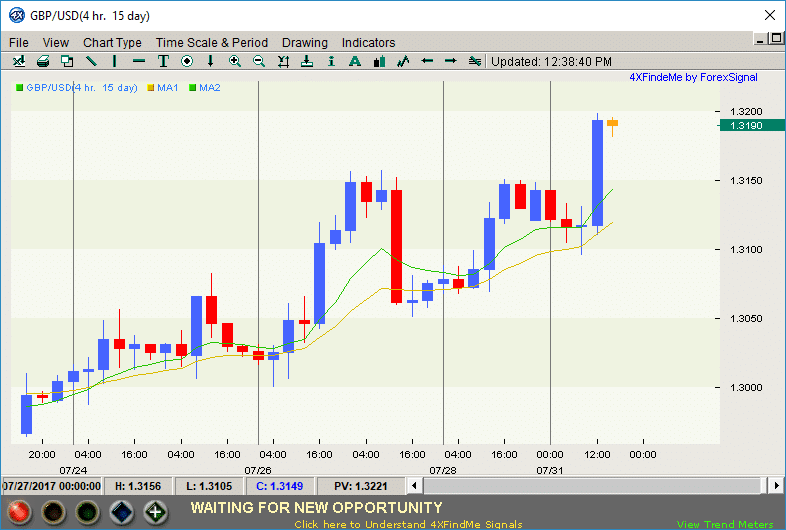

The cable is trending up against the USD, and is trading sideways against the euro. The BoE monetary policy committee will most likely leave its benchmark interest rate unchanged Thursday August 3rd, however the meeting could still have an impact on GBP/USD and EUR/GBP. The MPC is expected to vote 6-2 to leave the UK’s monetary settings where they are so the first risk is that more than two MPC members vote for a rate rise. The second is that the tone of the quarterly Inflation Report is hawkish and the third is that BoE Governor Mark Carney takes a hard line at his post-decision press conference. This may give further impetus to a strong sterling, especially in light of the weaker USD.

Forex Signal

Last week’s EUR/USD Forex Signal hit Target 3 early on Friday EST. We look forward to more Forex signals in the week ahead.

Political Tensions Trump Positive Economic Growth

Political Tensions Trump Positive Economic Growth

Leave a Reply

You must be logged in to post a comment.