Greenback – Any Hope?

There was no hope yet for the dollar bulls in last week’s trading session. The Republican Senate were unable to pass a new health care bill and this lead to the further downfall of the USD. The ground was already prepared since last week with the poor data presented coupled with Yellen’s caution. The situation was escalated by a deeper dive into Donald Trump’s dealing by Mueller. The news led to a further fall of the USD.

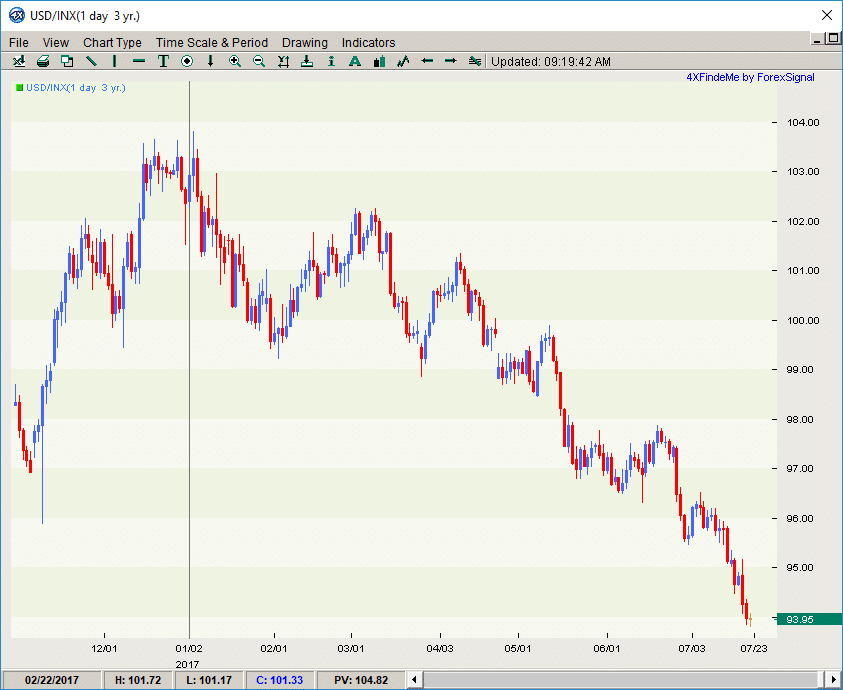

USD Index Yearly Low

U.S dollar index progresses lower to reach new yearly low of 93.85 and shows no sign of a bounce.

EUR/USD

EUR/USD progressing upside following the commentary by ECB President Mario Draghi. The pair getting near extreme high 1.1712 (Aug 2015 high) where the price fell in the previous bearish leg.

Support: 1.1615, 1.1712

Resistance: 1.1682

GBP/USD

The pair struggled to regain 1.3000 which it lost in the previous trading week, but managed to move above 1.3000 handles this week even reaching as a high as 1.3048.

Support: 1.2987, 1.2958

Resistance: 1.3000, 1.3052

USD/JPY

The greenback was weak as the pair currently hovering near 111.00 and risking more downward pressure. The downward movement might reach 110.50, but the pair might reverse its course if U.S dollar index bounces from its yearly low.

Support: 111.00

Resistance: 112.07

AUD/USD

Despite the reversal before touching 0.8000 touched, AUD/USD has been building toward this pivotal level. The pair last traded at 0.8000 in May 2015 and this big figure makes for major resistance ahead. The pair might experience profit-taking or sideways movement near the resistance before building on momentum to break 0.8000.

Support: 0.7900,

Resistance: 0.8000

Key Forex Events: Week of July 24th

With the greenback suffering for yet another week, will the Fed hit it when it’s down or mark a turnaround? Apart from the Fed decision, the upcoming week features consumer confidence, GDP, and durables, here are some more highlights for the upcoming week.

Highlights of the week:

- July 24: The Fed preview will hold on Monday with the question on everyone’s mouth: “Is inflation still transitory?”

- US Existing Home Sales: Also set for the same day (14:00), the data for June will be released and it is expected to slide down to 5.59 million which was below May’s 5.62 million.

- CB Consumer Confidence: Slated for Tuesday afternoon, this confidence measure by both the Conference Board and the University of Michigan’s measure have been sliding. The CB figure stood at 118.9 points in June. Another drop is expected, to 116.2 points this time.

- UK GDP: This session will occur on Wednesday morning. Growth rates in the second half of 2016, right after the EU Referendum, remained robust. Things deteriorated in 2017 with a significant slowdown to a final rate of only 0.2% q/q. Signs for Q2 haven’t been promising. Will we see contraction this time? This is not expected. A higher growth rate of 0.3% is forecast.

- US New Home Sales: It isn’t just the existing home sales that will be reviewed this week. Just before the Fed makes its decision, it will get an interesting indicator on Wednesday with this data. Sales of new homes are correlated with overall growth in the economy. The month of May saw an accelerated level of 610K. A small increase to 615K is predicted.

- US Durable Goods Orders: Thursday noon. The orders for durable goods dropped in May by 0.8% while core sales rose by 0.3% in the same period. The figure for June will be released on Thursday and it will feed into the GDP assessment. Core orders reflect investment, which is eyed by the Fed for future growth. Headline orders are predicted to jump by 3.2% while core orders carry expectations for a more modest advance of 0.4%.

- US GDP: Friday, 12:30.the GDP growth for Q2 2017 will be released and it is expected to show a pickup. The US economy grew by 1.6% in 2016 and 1.4% annualized in Q1 2017. This is below the “new normal” which is a mediocre 2-2.5%.

- Canadian GDP: This will be released at the same time as the US GDP. The Canadian GDP figures are released once per month though as this allows a closer look at the economy.

- US consumer confidence (revised): Friday, 14:00. This will be the closing activity of the week

We expect this busy week to provide the needed volatility for an active Forex trading week ahead and our Trading Team will be looking for opportunities to send Forex signals to our subscribers worldwide. We are not limited to selling the USD, although the greenback had a bad couple of weeks we will be alert to any trend to the USD upside and will send signals as the market confirms to our trading criteria in either direction.

Leave a Reply

You must be logged in to post a comment.