USD Index

The USD Index, used to measure the overall strength of the Greenback against a basket of other currencies, paused its post-election rally and reached its lowest level in 11 days after skyrocketing over 4% after Donald Trump’s surprise victory. This is the second day in a row and only the 3rd day altogether that the US Index has closed lower since November 4th.

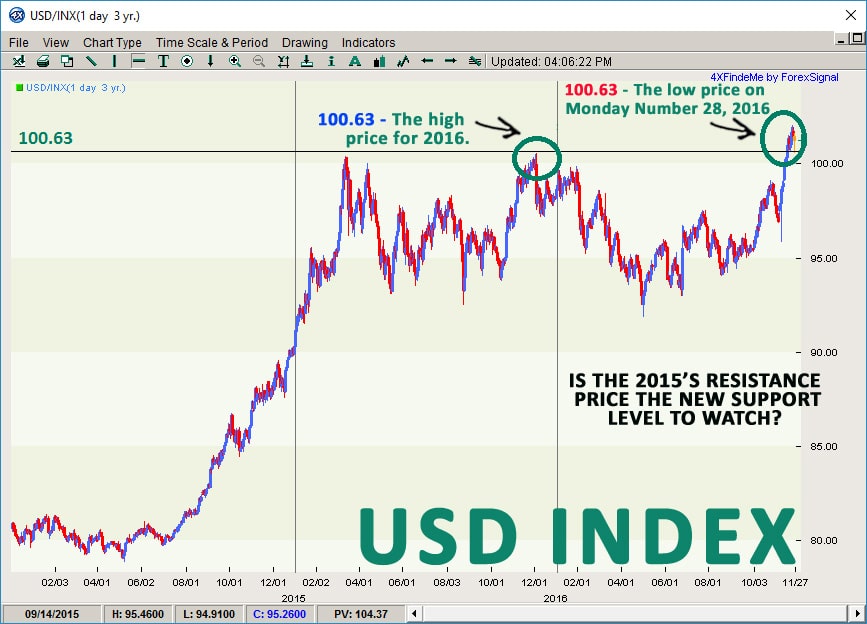

Noteworthy, the lowest point on the November 28th daily candlestick, 100.64, is the highest level that the USD Index saw in 2015 and we’ll watch that level as it may set up to become a strong level of support in future trading days if the USD Index does not break below that price.

The Yen Effect

As the Greenback traded lower, as usual the yen was a safe haven and rose against the USD, the Euro and the UK sterling.

Corrective Pullback

The surge in the Greenback in November has been attributed to investor confidence in the USD as the Trump administration is lining up their fiscal policy to boost inflation and adding to a hawkish view of an interest rate hike in 2017. But after rising to almost a 14-year high of 102.05 last week on Thursday November 24th, the dollar has retreated to a low on Monday of 100.63.

Most analysts see Friday’s dip as just a corrective pullback, which is to be expected after any rally; as traders took advantage of the holiday-shortened week to take profits. Monday’s continued Dollar selling was likely over market uncertainty over potential high risk events on the calendar this week.

Eyes On The Market

It takes more than two days of negative trading to fully end an upward rally, and our observations over the next few days should show whether the USD rally has slowed down or if the rally is just taking a pause to recharge batteries, so to speak. If we are just seeing minor pullback correction, then the rally may surge full speed ahead as the week progresses.

The week is lined with Wednesday’s OPEC meeting in Vienna and a stream of U.S. economic data is to be released, including ISM Manufacturing data and most noteworthy, Friday’s Non-Farm Payrolls report for November.

We expect a full and active week of Forex signals ahead.

Leave a Reply

You must be logged in to post a comment.