Will the U.S. Dollar Continue to Rise?

Will the U.S. Dollar Continue to Rise?

The most common question asked ever since the Trump administration took over the White House last month. Last week was quiet with the only the smallest tad of volatility after the Fed statement on Tuesday. And as we begin the new week, market movement has been minimal due to a Federal holiday in the USA.

The financial markets and banks are closed in the USA which means very little price movement in the Forex market.

No need to be concerned. We expect to see more trading opportunities for the rest of the week, especially from Wednesday onward.

Wednesday: Existing Home Sales

Wednesday February 22nd will be Existing Home Sales report out of the USA, and it is a big one. A mild outcome is expected with a print at 5.20 million compared with a 16-month high at 5.26 million for the month of January.

U.S. data results have increasingly outperformed forecasts over the past few months. It’s our firm belief that any rise in the numbers could boost the possibility of as upside surprise for the Federal Reserve to hike rates and send the USD through the roof. An anemic report could keep things on hold for months as far as the Fed is concerned and we can expect the exact opposite; a reaction to the Greenback and a few weeks of USD pressure.

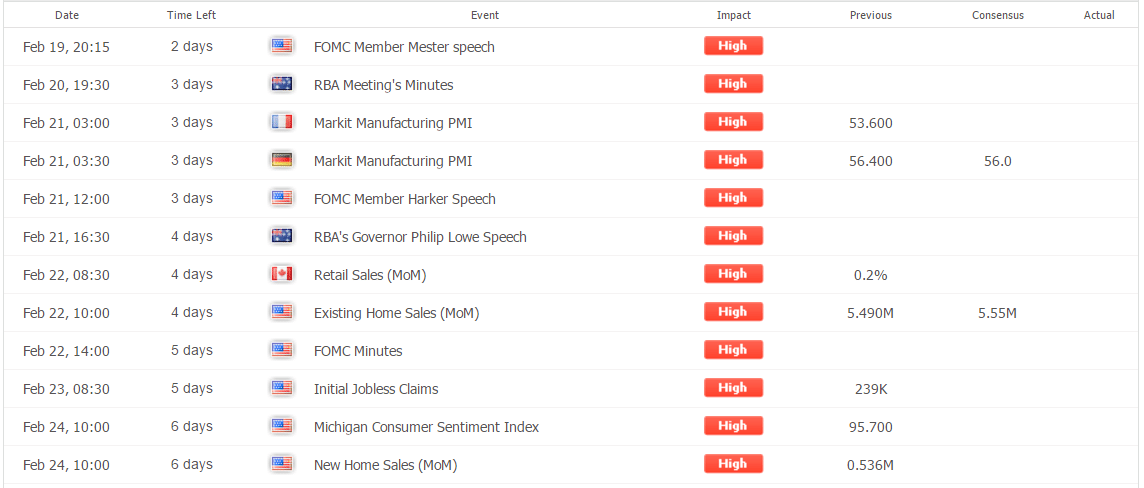

Economic Calendar

Other high impact events on the economic calendar this week as follows:

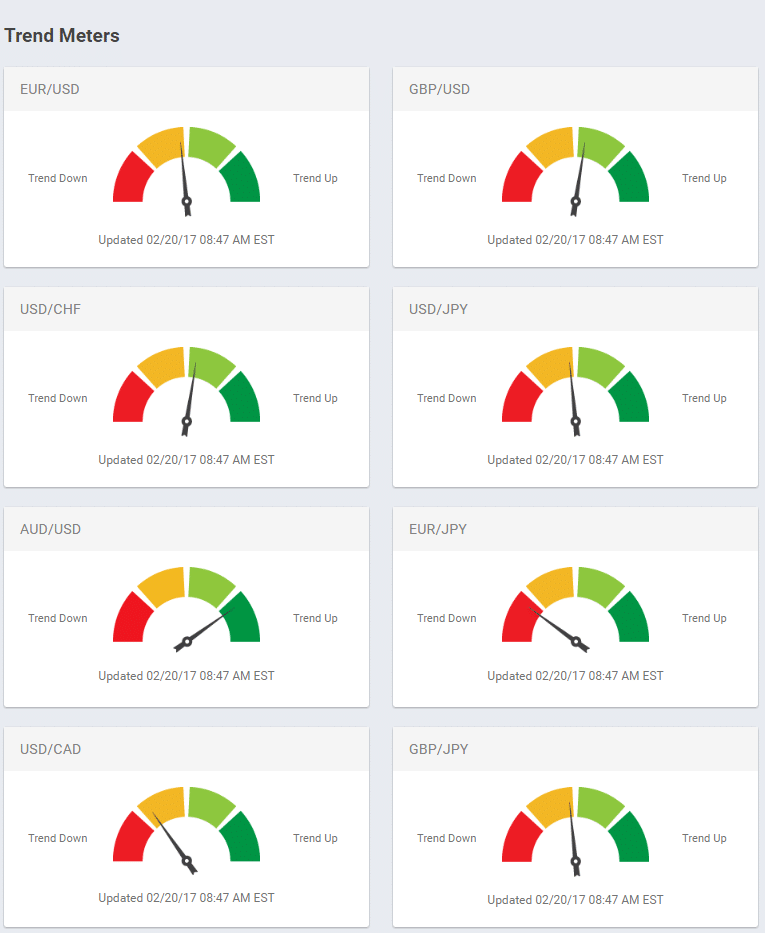

Trend Meters

The ForexSignal Trend Meters are updated daily and reflect the daily trend for each of the major currency pairs. ForexSignal subscribers can access the Trend Meters in their web dashboard at any time.

Today’s Trend Meters show clearly that almost across the board; aside from the commodity pairs AUDUSD and USDCAD, as well as also the EURJPY, most currency pairs are showing a weak trend in either direction.

Hopefully next week we will see the market showing more certainty in one direction or another once we see the results of the high impact events on the economic calendar.

Support and Resistance

The support and resistance (highs and lows) for trading on Tuesday February 21st.

EURUSD

High: 1.0674

Low: 1.0611

USDJPY

High: 113.50

Low: 112.61

GBPUSD

High: 1.2511

Low: 1.2387

USDCHF

High: 1.0029

Low: 0.9963

AUDUSD

High: 0.7713

Low: 0.7655

USDCAD

High: 1.3126

Low: 1.3059

Will the U.S. Dollar Continue to Rise?

Will the U.S. Dollar Continue to Rise?

Leave a Reply

You must be logged in to post a comment.