Hawkish Fed

Expectations of a Fed rate hike increase at the March meeting jumped above 50% as Bank of Dallas President Robert Kaplan stated that policy makers should raise rates “sooner rather than later”. Other Fed officials making speeches this week include Fed Chair Janet Yellen who will be speaking at an event in Chicago on Friday.

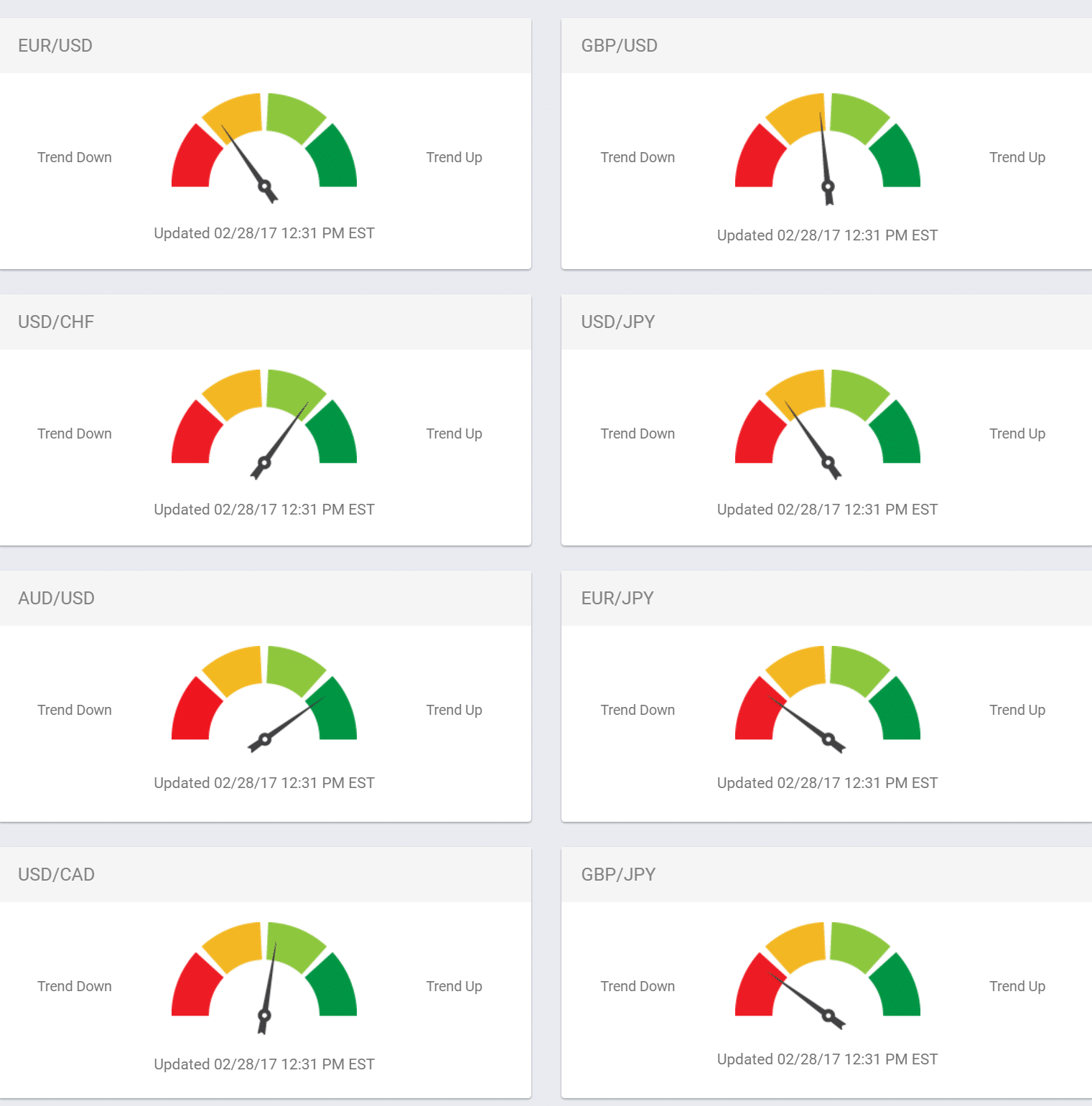

Trend Picks Up

After weeks of slow trading and little movement in the Forex market, our Forex daily Trend Meters are finally showing stronger direction, with a bias on a stronger Dollar against the European counterparts, but weaker against the Yen and struggling to get the better of commodity currency Aussie. The Greenback shows strength against its northern neighbor as the USDCAD soared to a monthly high of 1.3274.

As we see the market confirm to the current trend, the ForexSignal Trading Team expects to see more opportunities to send Forex signals to our clients world wide.

Support and Resistance

Here are the support and resistance levels to beat for the major currency pairs for trading March 1st:

EURUSD

High: 1.0629

Low: 1.0568

GBPUSD

High: 1.2470

Low: 1.2403

USDJPY

High: 112.81

Low: 111.68

AUDUSD

High: 0.7694

Low: 0.7665

GBPJPY

High: 140.31

Low: 138.82

USDCAD

High: 1.3283

Low: 1.3164

USDCHF

High: 1.0101

Low: 1.0008

Leave a Reply

You must be logged in to post a comment.