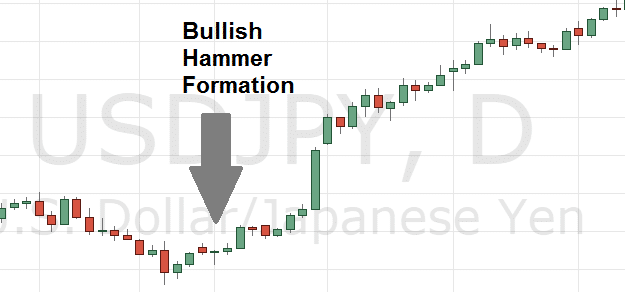

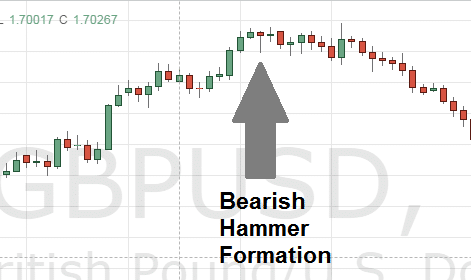

Forex candlesticks behavior can reveal future market trends and current market sentiment. For example, the Hammer or Hanging Man candlestick formation, which we will refer to as Hammer Formations, can indicate trend reversals. With their small bodies and long lower wicks, these formations look just like, you guessed it, a hammer!

Bullish Hammer Formations

Bearish Hammer Formations

How To Trade Hammer Formations

You can trade Hammer Formations in two ways.

1. Some traders will immediately enter the market once a hammer formation appears, in case the market does not have a pull back and the reversal occurs immediately.

2. On the other hand, some traders will enter the market after the currency pair attempts to retest the hammer level and does not break through, confirming the trend reversal.

Candlesticks

The ForexSignal.com Trading Team uses candlestick formations along with other criteria to provide their Forex Signals to clients all over the world.

If you would like to learn more about candlestick formations and other Forex trading technical analysis tools, please contact us about our mentoring program.

Leave a Reply

You must be logged in to post a comment.