Forex Trading Outlook: January 4-8, 2016

A slow start to the new Forex year is expected with the week picking up some momentum as we head toward Friday’s US Non-Farm Jobs Report (NFP) release. An upward momentum in US jobs and a possible decrease in the unemployment rate almost certainly will place added pressure on the Fed to announce another interest rate hike, possibly as soon as this month.

Regardless of whether that soon or not, another rate hike will definitely come; and the USD will soar even higher. A disappointing jobs report will generate a strong reaction and some strong short term USD selling can be expected. Whatever the outcome of the economic release, Friday should be most interesting.

Forex – Overall Long Term View

The ForexSignal trading desk is holding onto the same view we held for most of 2015. It’s all about the Greenback and we believe it’s ongoing strength will continue against most of the most majors and commodity pairs.

The only major pair in question right now may be the USD/JPY as the BOJ intervention last month put a damper on any further weakening of the Yen. We believe the next week or two will definitely provide the answer if this trend will hang in there or not. However if the Greenback experiences a surge anytime soon as result of weakening equity markets and in turn commodity prices, then all bets are off and we expect the Yen to follow suit with rest of the majors.

We wish all of our clients a happy and profitable trading week.

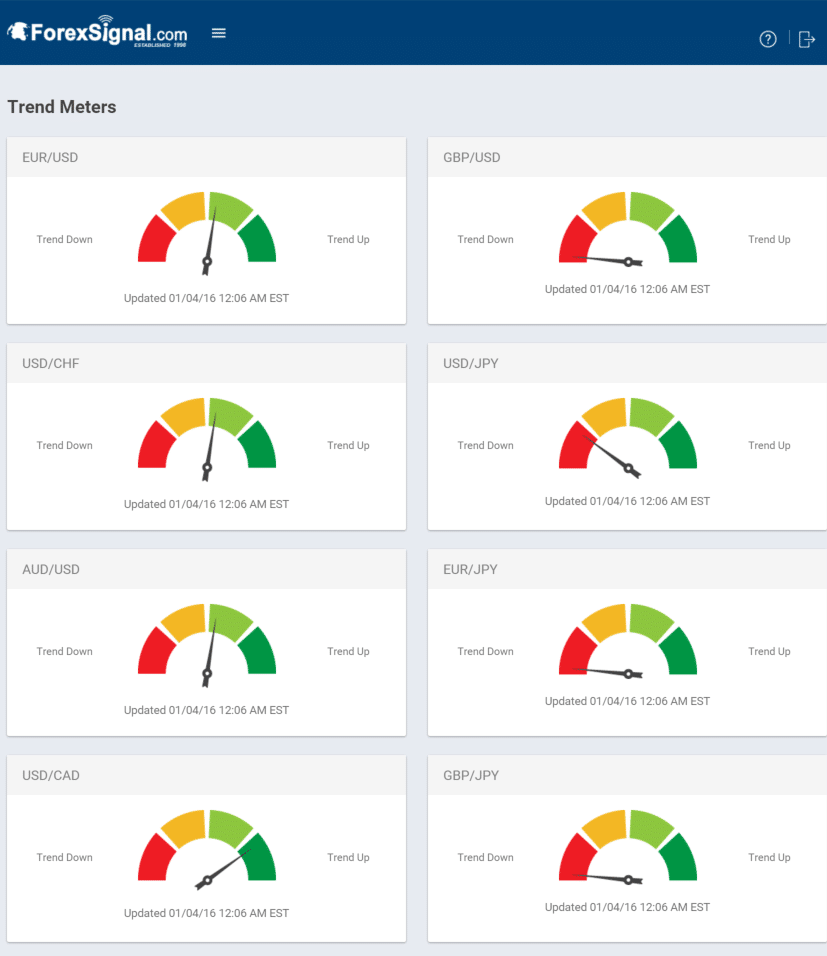

Trend Meters

Our Trend Meters are updated daily and are available with a ForexSignal subscription. See below for the Trend Meters shown as a screenshot at the start of this week January 4-8, 2016. ForexSignal.com subscribers can login to our ForexSignal.com members only platform to view current Trend Meters at any time.

Leave a Reply

You must be logged in to post a comment.