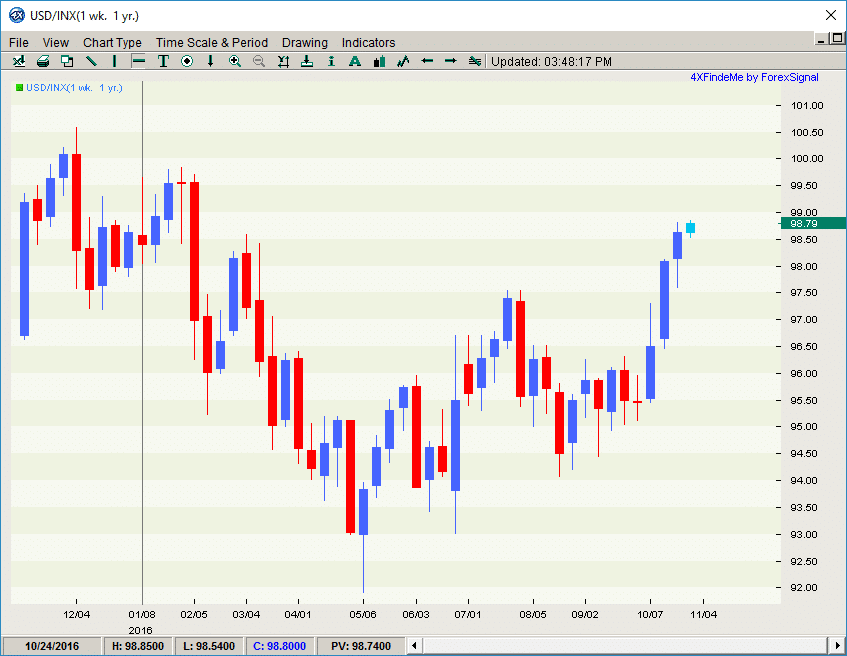

The USD Index, used to measure the strength of the Greenback against a basket of currencies, traded at its highest level since February 5, 2016 with the high of the day at 98.85.

Additional impetus for a strong US Dollar comes from recent polling that pins Hillary Clinton to win the upcoming US presidential campaign. The Greenback bulls tends to favor a Clinton win over a Trump win and the market reacts accordingly. This knowledge is important to Forex traders, as dramatic news about either candidate could lead to major Forex spikes, swings and overall volatility especially as we get closer to the November 8th election.

Euro Nearing Lowest Level Since March

While a strong Greenback has made headlines today, the Euro has hit a 7-month low despite recent upbeat data from the manufacturing and service sector. Declines are attributed to ECB President Draghi’s indications last week that the ECB may extend its stimulus program on into December.

The EURUSD is having difficulty breaking out of Friday’s low of 1.0858 and today this exact low was retested but not broken. A break below the 1.0858 level may signal continuing downward momentum as currency traders jump in to benefit from the selloff.

Week Ahead – Market Moving Speeches and Events

Speeches from UK’s Bank of England Governor Carney and European Central Bank president Draghi on Tuesday October 25th should shake things up for the sterling and Euro.

From Wednesday to Thursday, there are a few noteworthy releases out of the USA including the Consumer Confidence report, Goods Trade Balance, New Home Sales, Initial Jobless Claims, and most notably the Gross Domestic Product (GDP) report on Friday. A high reading will provide incentive to the already hawkish views of a Fed rate increase and should provide more stimulus to a strong Greenback and amplify expectations for a December rate hike. Australia has a busy week as well with 6 high alert economic releases on the calendar for the week ahead.

Monitor The Trend

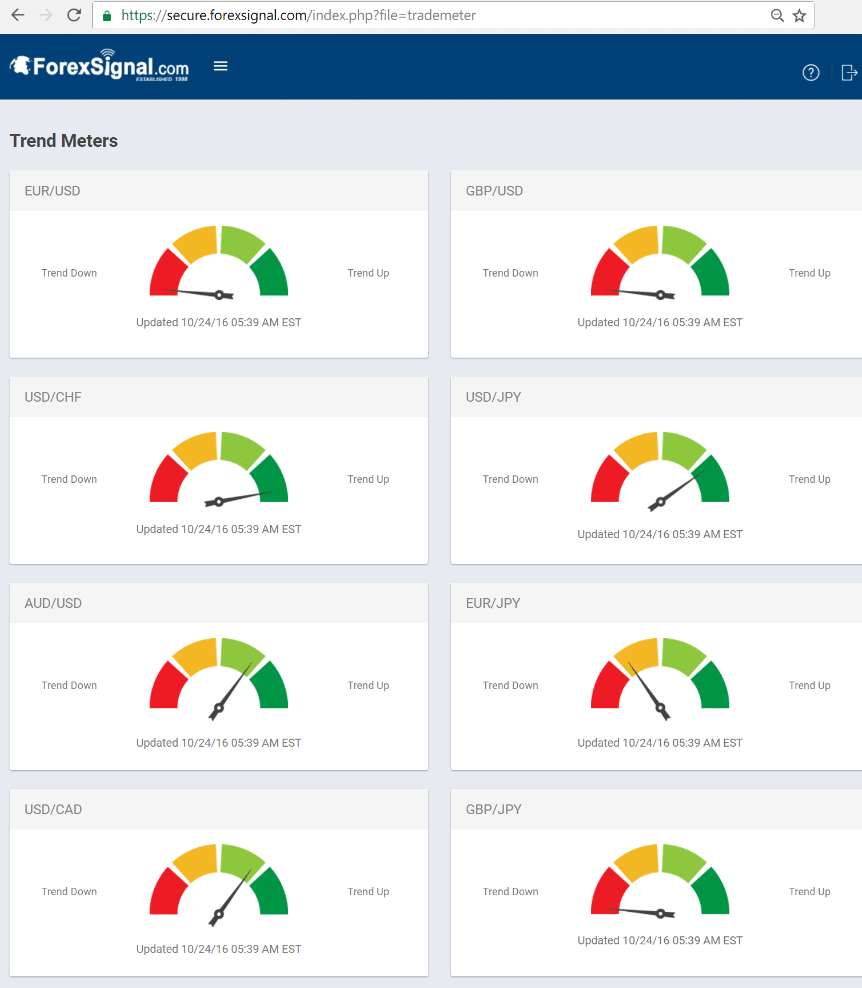

ForexSignal.com subscribers have access to our Trend Meters, updated daily. See below for the Trend Meters for October 24-25, 2016.

Leave a Reply

You must be logged in to post a comment.