USD Recovery

USD Recovery

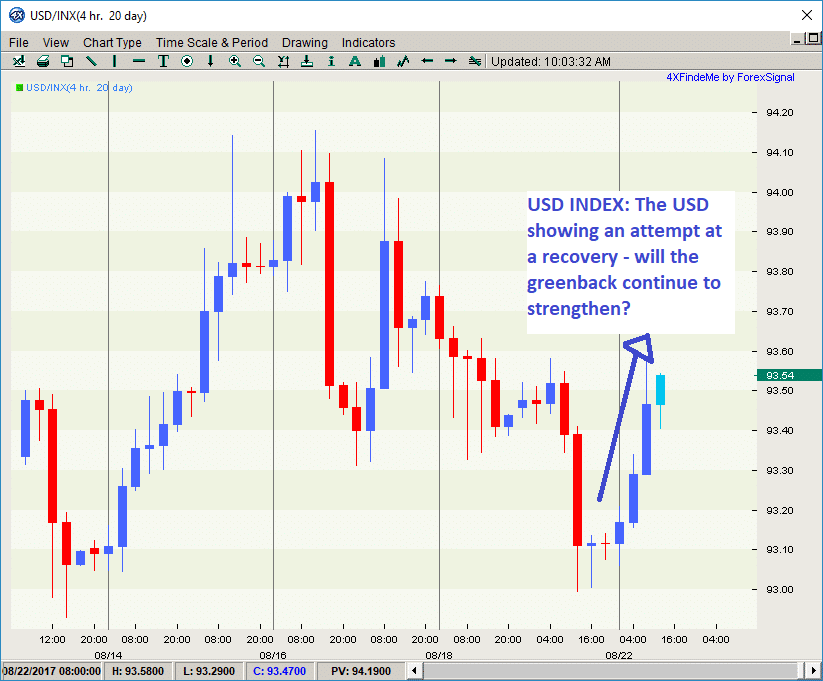

The greenback has been losing to its peer currencies for seven consecutive weeks now, and it comes as a relief now that it is finally showing signs of recovery. There was a high demand for the USD during yesterday’s session after the net value of short positions on the currency decreased from $10.23 billion to $8.84 billion, as calculated by Reuters.

Data Release

The rise in the greenback may be attributed to the latest U.S. CPI report, Dudley’s August 14 interview, and the latest U.S. retail sales report. Not all the results were positive as the core readings were reported to only gain a 0.1% month-on-month while the headline also had the same figures. This made the U.S. CPI report for July missed its expected target (both expected to rise by 0.2%). Despite this negative, the greenback still improved in general.

The other data that contributed to this rise include the headline year-on-year which even though it rose, (by 1.7%), it still didn’t meet the expected figure of +1.8%. the data though did put an end to four consecutive months of depleting annual readings, thus supporting the Fed’s forecast that CPI will begin to pick up soon. The annual core reading was also good as it came in at +1.7%, a similar figure to that of June. This implies that the underlying inflation was steady at least.

With so much data to be released this week such as the US new home sales and others, it will be very interesting to see how the greenback performs amidst its peers.

USD Index

The USD Index shows the USD steadily increasing during Tuesday’s trading session. Learn more about the USD Index.

Leave a Reply

You must be logged in to post a comment.