As we roll into March, I believe the Forex chips will start to fall into place. We start with the all-important question; will Global equities find the footing they are so desperately looking for? Oil prices should reveal the answer.

China and the US economy will also lead the way and March 4th US NFP Jobs Report will tell us exactly what’s truly going on and if the Fed will intervene. Simply put, if the Jobs Report is very positive then look out for rate hikes as early as the next Fed meeting. If the Jobs Report expectations are not reached or perform as expected, I just can’t see any rate hike on the horizon anytime soon.

Any weakness will hold back the Fed as a slip into negative territory, a very real threat, will put the brakes on predicted rate hikes until after the Elections in early November of this year. With the US Presidential elections dominating the news cycle it seems “it’s the economy, stupid” will once again dominate.

March 2016 – Euro Recovery Or Decline?

The Euro recovery was looking hopeful early February with new highs being made almost daily. We must have seen at least a handful head fake opportunities to buy the EUR/USD the last few month as we watched the market superbly set itself up for a classic short trade time and again. This past week we saw the Bears once again come out of hibernation and they came with a vengeance.

I don’t wish to repeat myself, but as I have said on a number of occasions, any recovery or new found strength seen by the EUR/USD can be considered an opportunity to short the Euro at an advantageous Entry Point.

As far as I’m concerned, unless there is a decisive break of the 1.1400 level during March on the EUR/USD, the Euro recovery is just not going to happen. If anything it looks more likely that an attack on the 2016 low of 1.0710 made in the first week of January is very much on the cards right now. A sustained breach of the 1.0700 level would mean it’s just a matter of time before parity for the EURUSD will be in the crosshairs.

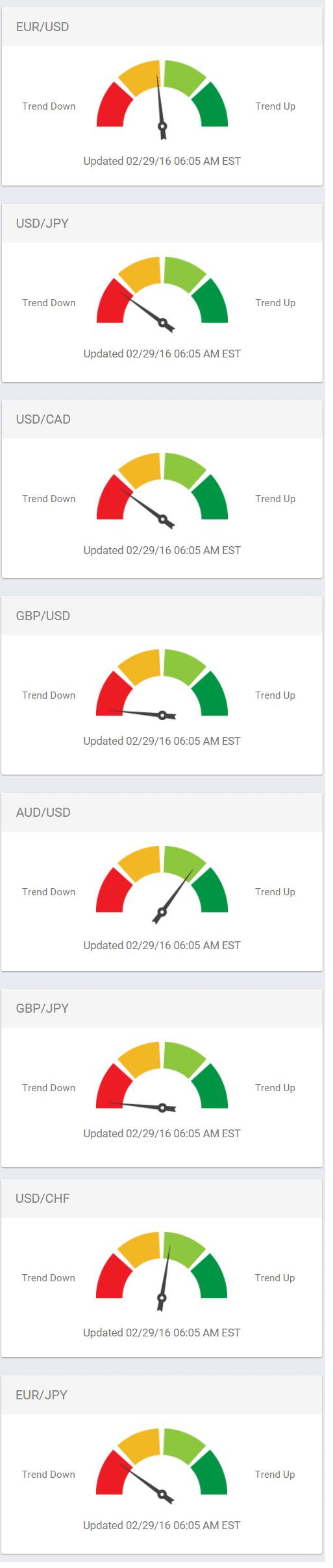

Trend Meters

Forex Trend Meters are updated daily and are accessible with a ForexSignal subscription. See below for a snapshot of our Trend Meters at the threshold of the month of March. ForexSignal.com subscribers can login to our members only platform to view current Trend Meters at any time.

Leave a Reply

You must be logged in to post a comment.