Forex Update – Mixed Signals

The markets have been up and down the past week and a half as it deals with seasonal lack of liquidity mixed with political and economical events.

Japanese Yen

Last week, the Japanese yen had yet another good outing and turned out to be the best-performing currency of the week. This was largely due to bond yields going down as bond-buying intensified, thanks to the severe risk aversion during the week.

Yesterday our ForexSignal Trading Team spotted a reversal on the EURJPY trend and we sent out a signal to buy the EUR/JPY at 129.50. Here is a screenshot of the trade:

Comdolls

The New Zealand currency started the week on a weak note as the previous week’s disappointing jobs report continued to weigh down on the currency. The AUD turned out to be the second worst-performing currency of the week after New Zealand’s Kiwi. Just like the Kiwi, the higher-yielding AUD went down in the dumps mostly because of the risk-off vibes this week.

The CAD had another rough week, after it lost out to everything except its fellow comdolls currencies. The CAD’s overall weakness last week can be attributed to another slide in oil prices.

USD, GBP

The USD followed up last week’s broad-based win with some mixed performance this week. The currency’s price action was haphazard, as there was diverging price action on some pairs. The GBP joined the greenback as it also had some chaotic and mixed price action last week. The price of the sterling was a mess as it also had lots of diverging price action. This ensured that the GBP, just like the USD, was vulnerable to opposing currency price action.

The sterling lost out to the greenback slightly since the USD’s negative reaction to the CPI report wasn’t enough to allow GBP/USD to fully recover when GBP/USD dropped lower from the Greenback’s bullish knee-jerk reaction to the Job Openings and Labor Turnover Survey (JOLTS) report.

The US consumer price index measure of inflation increased by 0.1% last week. It, however, failed to match the earlier expectation of a 0.2% rise as was earlier predicted. The greenback started out going down then bounced back against most of the major currencies as investors and traders cashed in on their profit ahead of the weekend.

Economic Data

This coming week, Friday’s US CPI and RBNZ midweek are scheduled but they will not be enough to stop the markets from turning volatile.

The first data release that was released this week is from New Zealand, where they released their retail sales on Sunday night. The first quarter release wasn’t favorable for the New Zealand economy as there was high inflation and high unemployment rate.

Monday saw the release of the Japanese GDP and Chinese industrial production data. Both pieces of data are very important for their respective currencies. On Tuesday, minutes from the RBA’s last policy meeting was released. The release did contain some surprises and saw a spike in the AUD. The German GDP, UK CPI, and US retail sales were all released on Tuesday. The focus on that release was on the following pairs; EUR/GBP, EUR/USD and GBP/USD.

Analyst has implied than any improvement in German data will only increase the pressure on the ECB to begin tightening its policy. The CPI or wages data will be released on Wednesday and a weakness in CP will likely see the GBP make a comeback. Eurozone GDP is due for release on Wednesday, as is the FOMC meeting minutes later on in the day.

On Thursday, the Australian jobs figures will be released. It will be closely followed by UK data in the form of retail sales, followed by the release of ECB’s last policy meeting minutes and a handful of US macro pointers including industrial production. Friday is the least busy day as the Canadian CPI and a US consumer sentiment index from the University of Michigan are the only data to be released.

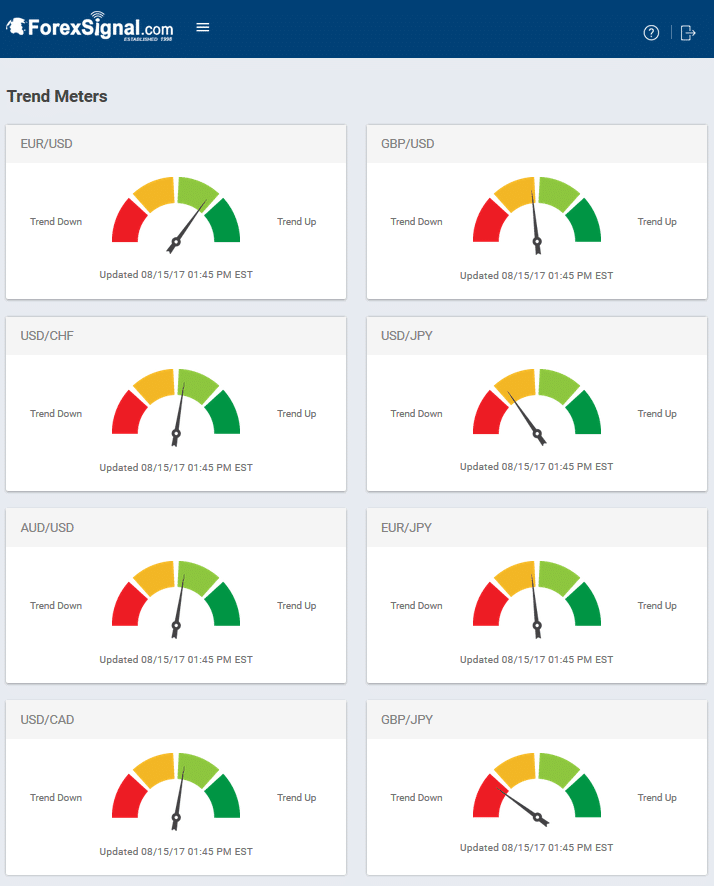

Forex Signal Trend Meters

The ForexSignal Trend Meters, updated daily, are used to observe the daily trend for each of the major currency pairs. If you are a ForexSignal.com subscriber, you can access the Trend Meters in your online web dashboard at any time.

Leave a Reply

You must be logged in to post a comment.