Uncertain Dollar Outlook

Until now, investors have received Donald Trump’s surprise victory with the biggest stock rally seen for any new President-Elect. Meanwhile, Morgan Stanley warns us of a “more uncertain and volatile outlook” for stocks after Inauguration Day, January 20th and that this will mark an end to the post-election climb. The bank’s opinion is that January 20th would be a good time to see a scaling back on equity holdings since the steady gain that began on November 8th.

“After all, what incrementally positive and exciting outcomes could be produced in the first few weeks after that?” wrote the Morgan Stanley team team, led by Chief Equity Strategist Adam Parker, “We can’t help but think that the Republican sweep has created a more uncertain and volatile outlook for the economy and corporate earnings growth.”

Morgan Stanley suggests that the prospect of looser regulation, decreased corporate taxes and other monetary policy decisions has investors venturing a growth expansion, continued surge in the Greenback and possible hawkish movement by the Federal Reserve to accelerate the increase in interest rates.

Other banks agree that investors are overly optimistic about the impact of Mr. Trump’s policies on the global trading.

Dollar Strength

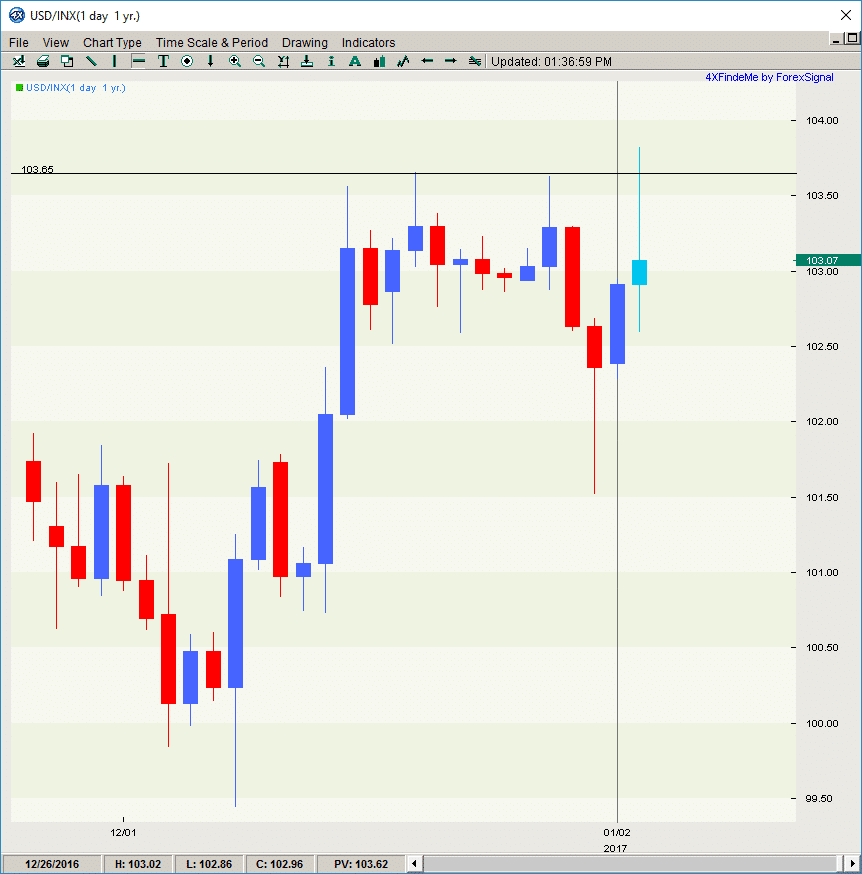

For now, we cannot see with complete certainty into the near financial future and behavior of the Forex currency pairs and other markets. But what we can see is the US Index, a measure of the strength of the Greenback against a basket of other currencies, has hit its highest level since the U.S. election and of course its highest level since 2002.

It appears a resistance level of 103.65 is the level to beat, and if the US Index breaks out of this level with a push of momentum, we may see a stronger USD rally in the days preceding January 20th.

Ready For Anything

Analysts did not predict Brexit, and investors did exactly opposite of what was expected when the results of the U.S. election strengthened the U.S. Dollar rather than tanked it. So rather than make grandiose predictions of what may happen after January 20th, at ForexSignal.com, we are armed to trade with the trend, whatever the trend may be.

For this first trading day of 2017 we are seeing a strong dollar bias as the yen slid to 118.59 per dollar, and the euro traded as low as $1.0339. As investors turn to a stronger Dollar, we see sustained losses on Gold. We see this taking its toll on the commodity pairs as the AUDUSD touched its lowest level since May 2016.

The Greenback also gained strength against the Sterling as the GBPUSD also dropped today and we were able to bank 60 pips in a short trade with our Trade Copier earlier.

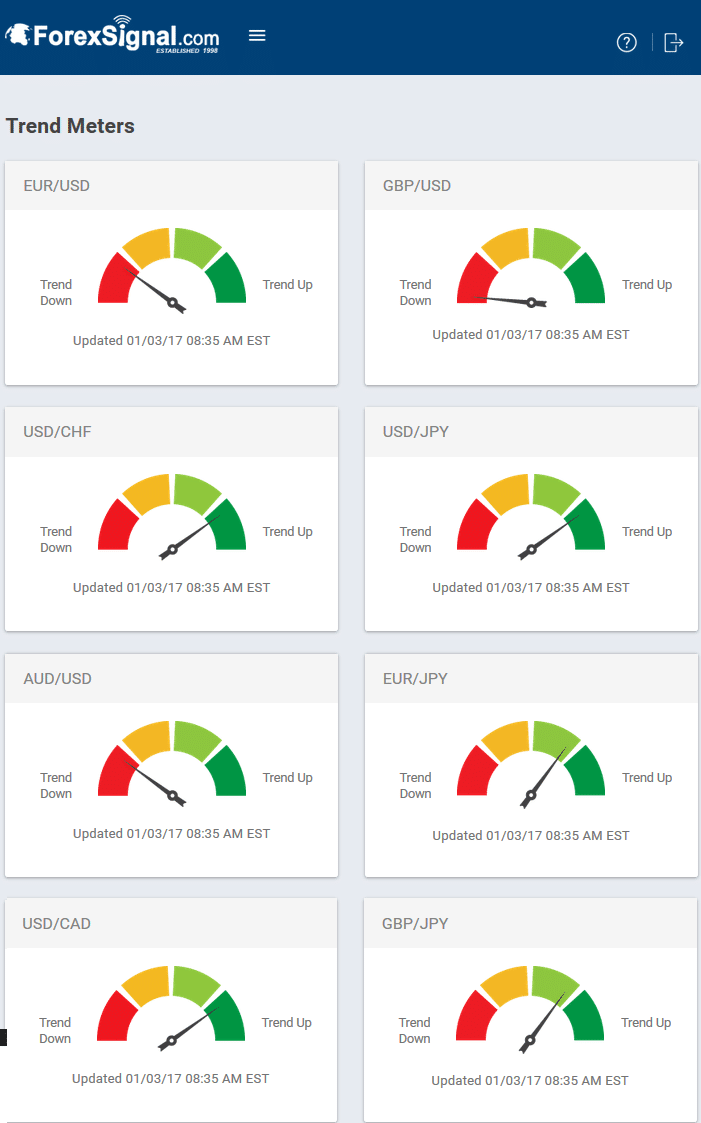

We measure the Forex trend daily using various tools and simple indicators, as taught in our Strategy 101 trading course. View our Trend Meters for January 3, 2017.

Leave a Reply

You must be logged in to post a comment.