How does the recent decline in oil affect the Forex market? Also, don’t be caught unaware of this weeks major market events with the upcoming FOMC and BOJ. And what can you do in a choppy, sideways market?

Oil Continues to Plunge

Toward the end of last week, we started to see a major recovery in the price of crude oil, but the gains are not holding and overall, the price of oil has dropped around 16% so far for 2016. Today’s slip in crude oil prices negatively affected stocks in Europe and the US, while the safe havens such as gold and the JPY rallied.

Expectations for Forex Trading

Overall for 2016, with recent stock selloffs and the plunge in oil prices, the Yen has gained against all of its major counterparts as demand for haven assets have increased. Many of the large financial players are looking at bullish yen positions, but we are holding our breath until the BOJ announces its monetary-policy decision on January 29th.

We see the Loonie weakening parallel to weakening crude prices, as well as the declining of other currencies of commodity producers.

We will also be keeping an eye on this weeks upcoming Federal Interest Rate decision which is scheduled to be announced on Wednesday January 27th at 14:00 New York time. Bloomberg reports that all 85 economists in their survey predicts that Interest rates will remain unchanged.

Where Does Forex Signal Stand?

The week has opened to a choppy and sideways market, which makes for difficult conditions for finding an Entry Point. One of our Forex Golden Rules dictates what to do at times like this:

GOLDEN RULE #6: "DO NOT FORCE A TRADE WHEN MARKET CONDITIONS ARE NOT FAVORABLE OR YOUR TRADING CRITERIA IS NOT REACHED"

But no doubt as the week progresses, this market uncertainty will reveal clearer direction and we will send out Forex Signals to our subscribers around the world. Generally speaking, at Forexsignal.com we are still strong believers that the run of the Dollar bulls is not over yet and we are looking for the market to offer favorable opportunities to buy the USD against the majors, with the exception of the JPY.

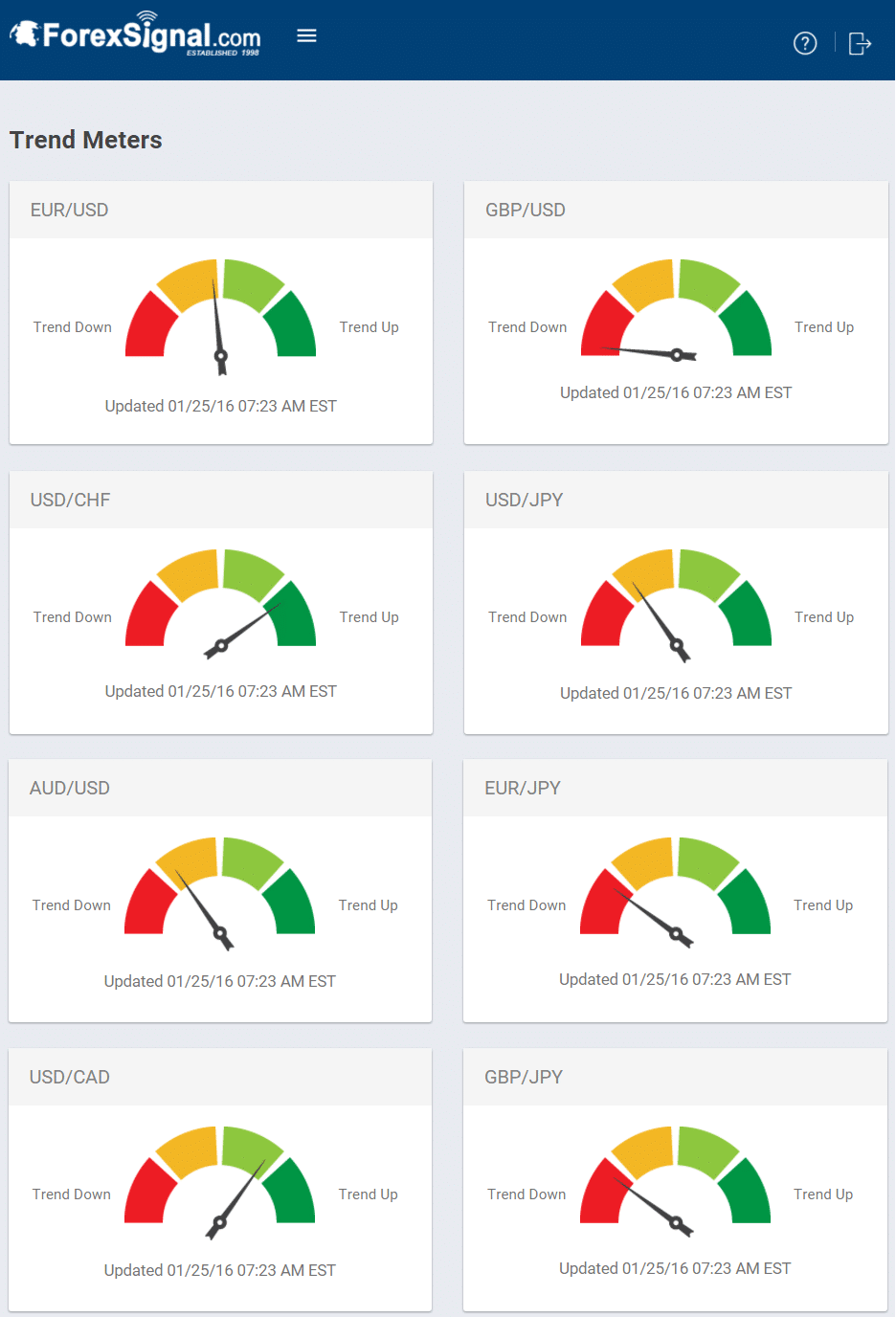

Trend Meters

Our Trend Meters show clearly our expectations for the week. ForexSignal Trend Meters are updated daily and are accessible with a ForexSignal subscription. See below for a snapshot of our Trend Meters as of January 25, 2016. ForexSignal.com subscribers can login to our ForexSignal.com members only platform to view current Trend Meters at any time.

Leave a Reply

You must be logged in to post a comment.