Euro Rally

Euro Rally

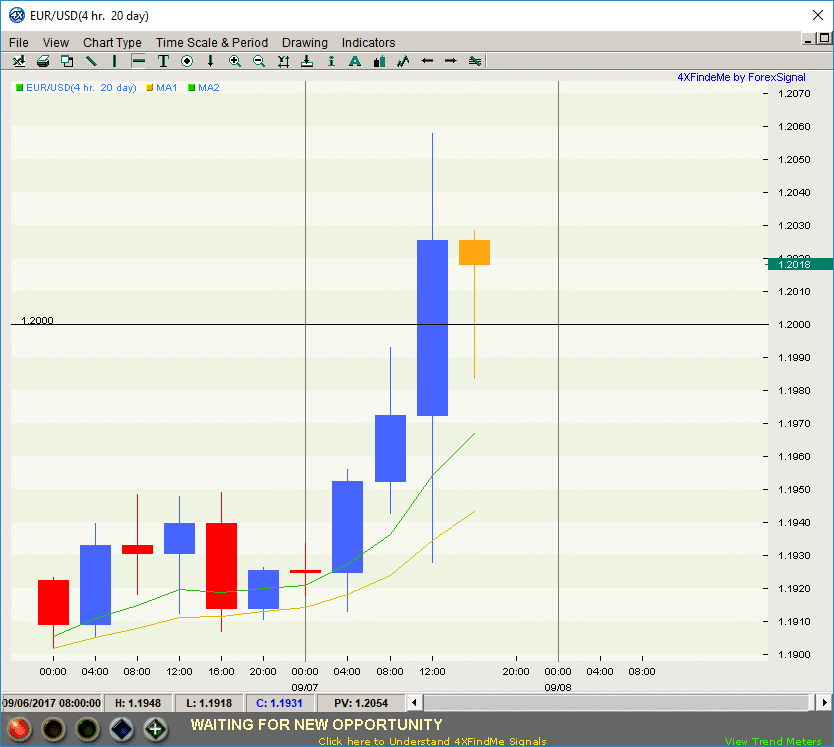

The single currency rallied to its highest level in 9 days as the European Central Bank (ECB) widely stuck to its outlook for growth and inflation while at the same time, expanding on recent concerns about the strength of the euro. The attitude of the ECB towards the euro’s 14% rise against the greenback in 2017 was at the center of the currency’s rally at the end of August.

Draghi’s casting of the euro and his continues stress that the forecast for growth, which has been largely unhindered, was enough to allow the euro to stroll past the set $1.20. The European shares increased after the European bank reaffirmed its ultra-easy position.

Bond Yields

The bond markets largely focused on the lack of a timetable for unveiling the European bank’s program for emergency bond purchases. This has sent the yields to be even lower. The 10-year government bond yield benchmark set by the Germans decreased by almost 3 points and now stands at 0.31%, the lowest it has been since June.

On the other hand, the Italian 10-year bond yield also crashed to around 1.938 percent. This figure is its lowest since June also. Portugal’s bond yields also fell by 9 bps to 2.76 percent. With this figure, they are very much on track to recording their biggest fall in a day since July. ECB’s president Draghi pointed out that the strength of the euro is very much at risk. The currency initially went up after he acknowledged that the ECB was keeping its projected growth and inflation levels unchanged. The euro immediately fell by just under a cent from its high position when he made mention that the recent volatility in the exchange rate has been a source of uncertainty. This, he argued, contributed to the trimming of some of the bank’s inflation forecasts

USD Index

After the speech made by Draghi, the euro was trading at $1.1997, which was an increase of 0.7%. This contributed to the fall in the USD index, which reached its weakest level since January 2015.

Leave a Reply

You must be logged in to post a comment.